[ad_1]

That’s the subtitle of an NBER working paper by Charles Grey, Abby E. Alpert & Neeraj Sood. The writer look at latest mergers between pharmacy profit managers (PBMs) and well being insurers. On the one hand, integration could helpful to customers. It may: (i) enhance operational efficiencies, and (ii) higher align PBM incentives with these of the well being plan (e.g., higher accounting for medical prices offsets). Nevertheless, the authors additionally word that there are two pathways by which the combination may go away customers worse off: (i) enter foreclosures and (ii) buyer foreclosures.

Enter foreclosures happens when a PBM owned by an insurer will increase the prices or reduces the standard of its providers offered to insurers who compete with its father or mother insurer. For instance, the PBM may move by a bigger share of producer rebates to its father or mother insurer than it passes by to rival insurers. The diploma of enter foreclosures relies on the extent of competitors within the PBM market. If PBM markets have many opponents, then enter foreclosures is much less seemingly as rival well being plans experiencing enter foreclosures can change to one among many standalone PBMs. Nevertheless, if PBM markets are extremely concentrated then enter foreclosures is extra seemingly as rival plans have restricted choices to modify to a different PBM. Buyer foreclosures, in contrast, happens when the downstream agency of a merged entity now not purchases inputs from its upstream opponents. For example, when an insurer and PBM consolidate, the insurer’s well being plans will all the time use providers from its personal PBM, thus lowering the potential variety of purchasers for standalone PBMs. The discount within the potential buyer base may finally lead standalone PBMs to exit the market which might additional enhance the focus of PBMs.

The authors use a lot of completely different datasets together with (i) publicly accessible CMS PDP Panorama file datasets on Medicare Half D plan traits and enrollment (2010-2018), (ii) CMS Half D Contract and Enrollment Information include info on plan’s annual enrollment, and (iii) Resolution Sources Group

(DRG) Managed Market Surveyor (MMS) (2010-2018) to establish which PBM every Half D plan makes use of.

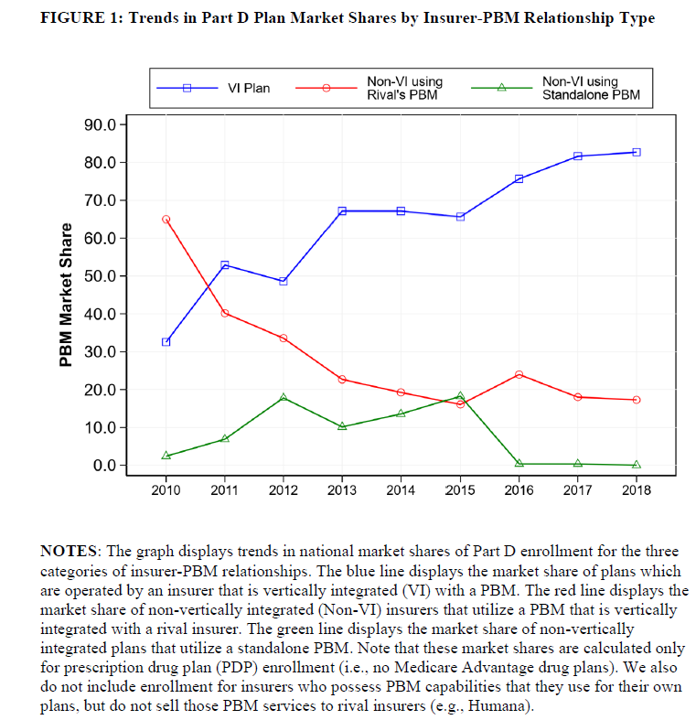

Then, they carry out a difference-in-differences (DD) evaluation trying on the Half D market earlier than and after a big 2015 insurer-PBM merger (UnitedHealth-Catamaran), which the authors declare “eradicated the final vital standalone PBM and shifted extra insurers into contracts with vertically built-in PBMs.” The pre-post evaluation compares modifications in premiums for vertically built-in plans (i.e., plan owns their very own PBM) in comparison with non-vertically built-in plans.

Utilizing this method, the authors discover that:

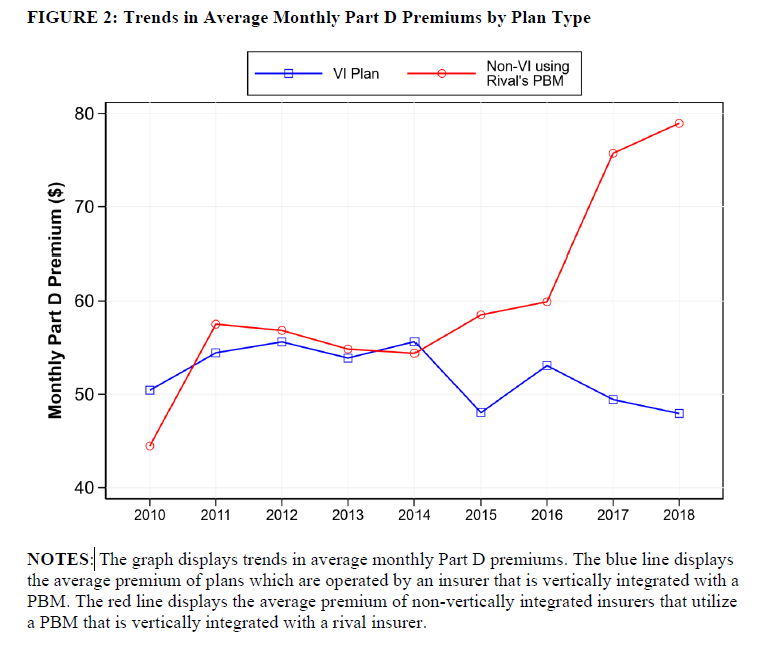

…nonvertically insurers skilled premium will increase of 36% when in comparison with vertically built-in insurers. These findings are in keeping with vertically built-in PBMs partaking in enter foreclosures. Particularly, a vertically built-in PBM had a bigger incentive to lift prices for rivals when these rivals misplaced the flexibility to substitute to a standalone PBM.

The figures under present that (i) vertically built-in plans started to dominate the market and (ii) costs for non-vertically built-in plans elevated greater than for vertically built-in plans.

[ad_2]