[ad_1]

Congress handed the Company Transparency Act (the “CTA”) in 2021 with the goal of enhancing transparency in entity buildings and possession in addition to combating terrorism, cash laundering, and different types of company misconduct. This sweeping new rule is designed to forged a large internet over entities that, besides within the case of taxes, don’t often report back to federal businesses (i.e., non-publicly traded entities), whatever the diploma to which they’re already regulated on the state degree. This submit particularly speaks to medical teams and administration providers organizations (“MSOs”) that now must navigate the brand new CTA necessities and account for his or her complicated contractual relationships (e.g., administration providers agreements, fairness restriction or succession agreements). For added info on a specific subject, hyperlinks to useful sources have been offered within the footnotes.

Broadly talking, the CTA requires that any entity that qualifies as a “reporting firm” file a Helpful Possession Info Report (“BOIR”) to the Division of the Treasury’s Monetary Crimes Enforcement Community (“FinCEN”) disclosing figuring out info for such entity’s key house owners and leaders (“useful house owners”). Corporations fashioned on or after January 1, 2024, should additionally embody info on the person who supervised the preparation of the certificates of formation of the reporting firm in addition to the person who filed such doc with the Secretary of State within the state of formation (known as the “firm applicant”). Whereas this reporting requirement shall be new for a lot of privately owned entities, the excellent news is that the BOIR is pretty easy, and FinCEN has confirmed that any info submitted in a BOIR shall be confidential. Authorities officers could solely entry such info for nationwide safety, intelligence, and legislation enforcement functions. Moreover, monetary establishments could solely entry the knowledge with the consent of the reporting firm.[1]

Even so, the CTA has sparked substantial public commentary across the nuances of reporting and the scope of potential exemptions. For entities that traditionally haven’t needed to make a majority of these disclosures, the CTA raises plenty of questions, together with whether or not an entity can qualify for an exemption, and if not, what info have to be reported to the federal authorities. There may be time to assume by these questions. Reporting corporations that aren’t exempt and have been registered to do enterprise with their relevant Secretary of State previous to January 1, 2024, have till January 1, 2025 to file their BOIR. The timeline for newer reporting corporations is a bit of shorter: these registered between January 1, 2024 and January 1, 2025, may have ninety (90) days following registration to file, and people registered after January 1, 2025, may have thirty (30) days following registration to file.

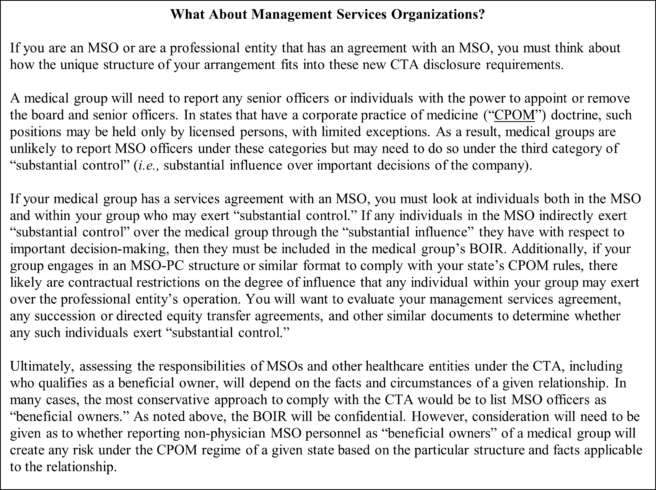

The CTA’s utility to frequent company buildings within the healthcare business (e.g., “pleasant doctor” and MSO relationships) raises questions for reporting corporations topic to the brand new necessities. Specifically, medical teams might want to think about whether or not particular person leaders of an MSO needs to be reported as “useful house owners” of an affiliated medical group. Like different healthcare compliance points, every reporting firm ought to think about the information and circumstances of its current relationships and, for medical teams, whether or not an MSO relationship will influence its BOIR submission (e.g., the diploma of management afforded to the MSO underneath its administration providers settlement, any relevant CPOM doctrine(s), and the concerned reporting entity’s evaluation of its authorized duties and diploma of danger tolerance).

Right here, we element three steps to contemplate with respect to CTA reporting for medical teams and MSOs:

Step 1: Are You a “Reporting Firm” and, If So, Does an Exception Apply?[2]

An entity is a reporting firm if it was fashioned or registered to do enterprise by submitting with any Secretary of State or related workplace inside the US (e.g., an organization or LLC). Which means that any skilled company or skilled restricted legal responsibility firm is a reporting firm, however a sole proprietorship or common partnership that’s not registered with a Secretary of State or related state workplace just isn’t.

Even when your entity is a reporting firm, it could meet one of many exceptions underneath the CTA that eliminates the reporting requirement. The exceptions are primarily designed to exempt bigger corporations with energetic operations, public corporations, and different entities that already report back to the federal authorities (i.e., these registered with the Securities Trade Fee (“SEC”), together with funding corporations, funding advisers, enterprise capital fund advisers, and pooled funding automobiles). Tax exempt entities, similar to charitable organizations organized underneath IRS Code 501(c)(3), in addition to any entities wholly owned by a number of exempt entities are excluded as effectively. Inactive entities additionally don’t must report.[3] Lastly, the Massive Working Firm (“LOC”) exception waives an entity’s reporting obligation if it satisfies the entire following necessities: 1) employs twenty-one (21) or extra full-time workers within the U.S. (impartial contractors, leased workers, [4] or, for an S company, any shareholder proudly owning two % (2%) or extra possession[5] don’t rely as workers), 2) generates greater than 5 million {dollars} ($5,000,000) in annual gross receipts (as reported within the federal revenue tax returns of the 12 months prior), and three) has an working presence at a bodily workplace within the U.S.[6]

If your organization meets any of the above exceptions, it’s not required to file a BOIR. In any other case, it would be best to begin fascinated about which people have to be recognized within the BOIR.

Step 2: If You Should File a BOIR, Determine Your “Helpful Proprietor(s).”

A. Who’s a “Helpful Proprietor?”[7]

A useful proprietor is a person who, straight or not directly, both 1) workouts substantial management over a reporting firm, or 2) owns or controls a minimum of twenty-five % (25%) of the “possession pursuits” of a reporting firm.

B. What’s an “Possession Curiosity?[8]

An possession curiosity consists of, however just isn’t restricted to, any of the next: 1) fairness, inventory, or voting rights, 2) a capital or revenue curiosity, 3) convertible devices, or 4) choices or different non-binding privileges to purchase or promote any such pursuits.

C. What’s “Substantial Management?”[9]

A person has “substantial management” in the event that they meet any of the next three standards: 1)serves as a senior officer of the corporate, 2) holds authority over the appointment or elimination of senior officers or a majority of the board, or 3) has substantial affect over necessary selections of the corporate. In defining “senior officers,” FinCEN expressly consists of the President, CEO, CFO, GC, COO, or some other officer who performs the same perform, and expressly excludes any ministerial positions similar to a Company Secretary or Treasurer. For healthcare entities, sure officer positions, similar to CMOs, don’t appear to suit neatly into both a “senior officer” or “ministerial” function. The most secure strategy is prone to embody such people within the report, however the choice warrants case-by-case consideration.

When deciding whether or not a person meets the third class of “substantial affect over necessary selections,” the CTA seems to people who’ve substantial affect over any of the next selections: 1) the character, scope, and attributes of the corporate together with the sale, lease, mortgage, or different switch of principal belongings, 2) any reorganization, dissolution, or merger, 3) the choice or termination of enterprise strains or ventures, 4) any compensation schemes or incentive applications for senior officers; and 5) the entry into or termination of great contracts.

The CTA features a catch-all provision to make clear that substantial management can take extra types not particularly listed. Moreover, substantial management additionally consists of management exerted by any dad or mum or middleman entities. Thus, if any people from different entities exert management over your organization pursuant to the above classes, you’ll need to incorporate them in your BOIR.

Step 3: Think about the Who, What, When, The place and How of CTA Reporting

Reporting corporations should embody info on each the reporting firm and any useful house owners. Moreover, any corporations fashioned after January 1, 2024, should embody info on firm candidates. FinCEN has extra sources accessible on-line for newly fashioned reporting corporations. Reporting firm info consists of: 1) its full authorized identify, 2) any commerce identify (i.e., “d/b/a”), 3) a enterprise avenue handle (this can’t be a PO field or any third get together’s handle), 4) the state of formation the place the corporate first registered, and 5) its taxpayer identification quantity.

Helpful proprietor info consists of every particular person’s: 1) full authorized identify, 2) date of beginning, 3) residential avenue handle (this can’t be an organization handle), 4) ID quantity and issuing jurisdiction of a non-expired US passport, driver’s license, or different government-issued ID, and 5) a picture/photocopy of such ID. If the person doesn’t want for his or her ID to be saved within the BOIR (Gadgets 4 and 5), they will apply for a singular figuring out quantity by FinCEN (a “FinCEN Identifier”). To take action, a person should submit all useful proprietor info outlined above (together with an ID quantity and photocopy) by the FinCEN web site right here, FinCEN ID | Monetary Crimes Enforcement Community (FinCEN). The FinCEN Identifier can then be submitted on the BOIR in lieu of Gadgets 4 and 5 above.[10]

Corporations could make the report electronically at BOI E-FILING (fincen.gov) by both submitting a pdf type or coming into the knowledge straight. Recall that reporting corporations fashioned previous to January 1, 2024, don’t want to incorporate firm applicant info. Merely test the field in Merchandise 16 to skip Half II on firm candidates. The deadlines for reporting corporations based mostly on their date of state registration are outlined above.

FOOTNOTES

[1] See Part A of Helpful Possession Info Reporting FAQ, Helpful Possession Info Reporting | FinCEN.gov.

[2] See Pages 2-14 of Small Entity Compliance Information, FinCEN (hereinafter, the “FinCEN Information”) https://www.fincen.gov/websites/default/information/shared/BOI_Small_Compliance_Guide.v1.1-FINAL.pdf.

[3] Id. at p. 14.

[4] 26 C.F.R. § 54.4980H-1; 26 C.F.R. § 31.3401(c)-1.

[5] 26 C.F.R. § 54.4980H-1.

[6] Though consolidated teams could mixture gross receipts for the LOC exception, the variety of workers in a gaggle is probably not consolidated, which means every firm should have 21 or extra US workers to qualify for the exception.

[7] FinCEN Information, p. 16.

[8] Id. at p. 18.

[9] Id. at p. 18.

[10] See Part M of Helpful Possession Info Reporting FAQ, Helpful Possession Info Reporting | FinCEN.gov.

[ad_2]